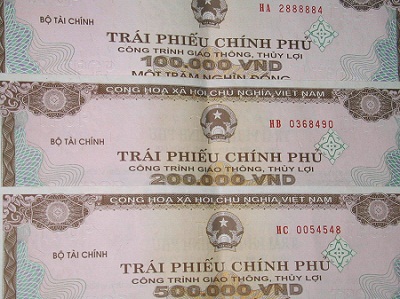

PM approves development roadmap for bond market in 2017-2020

VGP – The PM has recently approved the Bond Market Development Roadmap for the 2017-2020 period, with a vision towards 2030, aiming to develop a stable bond market with a synchronous and complete structure in terms of supply-demand factors.

|

Under the roadmap, the Government expects to increase the outstanding debt of the bond market to about 45% of GDP by 2020 and about 65% of GDP by 2030, with the outstanding debt of the government bond, government guaranteed bond and local government bond market accounting for 38% of GDP by 2020 and about 45% of GDP by 2030. Meanwhile, the outstanding debt of the corporate bond market will reach about 7% of GDP by 2020 and about 20% of GDP by 2030.

The average duration of local currency Government bonds issued in the period of 2017-2020 will reach 6-7 years, and 7-8 years for the 2021-2030 period. The average trading volume of government bonds, government guaranteed bonds and local government bonds per trading session will increase by 1% of the outstanding debt of bonds listed on the stock market in 2020 and 2% in 2030. Meanwhile, the proportion of government bonds, hold by insurance companies, the Social Security, pension funds, investment funds and non-bank financial institutions, will rise to 50% in 2020 and 60% in 2030.

In order to realize the aforementioned goals, during the 2017-2020 period, the Government will finalize a policy framework on the bond market, develop the primary and secondary markets, diversity the system of investors, and develop intermediary institutions and market services.

Concerning the primary market, the government will diversify government bond, government guaranteed bond and local government bond products in order to meet the investment demands of investors, while focusing on issuing government bonds and government guaranteed bonds in the form of bidding.

With regards to the secondary market, the government will renovate the organizational model of the bond market as well as upgrade the bond trading system at Stock Exchanges, whilst ensuring the timely and accurate reporting of trading conditions in order to build a standard yield curve on the market./.

By Vien Nhu