VN has no intention for currency manipulation, experts say

VGP – Viet Nam has no intention to manipulate its currency to gain export advantages and the economies of Viet Nam and the U.S. are supplementary, experts said in response to the U.S. Department of Treasury's recent report.

|

|

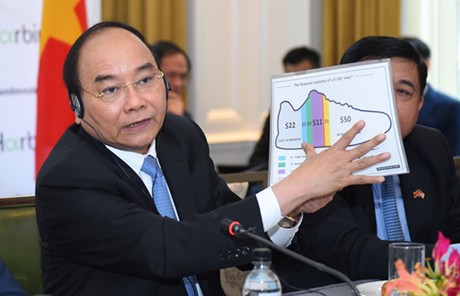

Prime Minister Nguyen Xuan Phuc uses the image of shoes to illustrate the profits of U.S. investors in Viet Nam when he attends a round-table talk on the Viet Nam-U.S. investment cooperation in New York in May, 2017. Photo: VGP |

Last week, the U.S. Department of Treasury released a report labeling Viet Nam and Switzerland “currency manipulators” as both countries met all the three criteria under the Trade Facilitation and Trade Enforcement Act of 2015.

Dr. Truong Van Phuoc, former acting president of the National Financial Supervision Committee said there are several points of the Treasury’s report that need to be clarified.

First of all, Viet Nam’s trade activities over the past more than 30 years reflect the process of economic transition to market-oriented economy with prominent features like cheap labor and inflows of foreign investment, thus exports become cheaper.

Second, Viet Nam’s total trade surplus with the rest of the world was normally about US$5-10 billion a year, with exception of US$20 billion in 2020.

The country gained current account surplus mainly because of the inflows of remittances with the remittance volume decided by overseas Vietnamese, Phuoc said.

The exchange rate has not been the factor that leads to the current account surplus exceeding the Treasury’s threshold of 2%, he added.

Third, regarding foreign exchange intervention, Phuoc said Viet Nam’s current legislation does not allow foreign currencies to be used as mean of payments within the territory of Viet Nam.

Investors who transfer foreign currencies to Viet Nam to do business shall have to convert foreign currencies into Viet Nam Dong. Export earnings and remittance transferred back to Viet Nam shall also be converted into Viet Nam Dong.

The purchase of foreign currencies by the State Bank of Viet Nam (SBV) is mandatory as prescribed by laws to facilitate the conversion of foreign currencies into Viet Nam Dong.

In recent years, the annual average inflation rate was around 4% therefore it is understandable that the Viet Nam Dong weakened by 1-1.5%. Even when the inflation rate reached 5-6%, the Viet Nam Dong only depreciated by 1-2%.

Echoing Phuoc’s views, Dr. Tran Du Lich affirmed that Viet Nam has had no currency manipulation policy at least since 1999 when he became member of the National Financial and Monetary Policy Advisory Council.

Now, Viet Nam still remains a contract-based economy, it has no reason to devalue the national currency as it only leads to high input costs and even national debt, Lich said.

Viet Nam achieved export surplus with the U.S. as the two economies are supplementary. Vietnamese exports mainly compete with those of the third countries, not American businesses in the U.S. This only benefits the American consumers.

It is worth to note that Viet Nam has tried to balance trade with the U.S. by facilitating U.S. investment inflows and increasing imports from the U.S. The Southeast Asian country also posts trade deficit with many other countries.

According to the General Department of Viet Nam Customs, Viet Nam spent US$12.45 billion on American goods in the first 11 months this year despite the Covid-19 pandemic.

Last year, the U.S. was Viet Nam’s fourth largest import source with US$14.36 billion, up 12% from 2018. The figure included US$4.85 billion spent on computers, witnessing a year-on-year increase of 59.14%.

In his response to the Treasury’s report, Adam Sitkoff , Executive Director of the American Chamber of Commerce in Viet Nam said “currency manipulation has not been an issue for our membership, and any potential action in the final days of this administration to harm Viet Nam’s economy with punitive tariffs will damage the close partnership the two countries have developed over the years.”

He expressed his belief that Viet Nam and the U.S. have developed a healthy commercial relationship that has created jobs, tax revenues, and opportunity for citizens of both countries./.

By Quang Minh

Follow us on Twitter @VNGovtPortal and Facebook page @VNGov