VN among top FDI recipients in ASEAN in 2016-2017

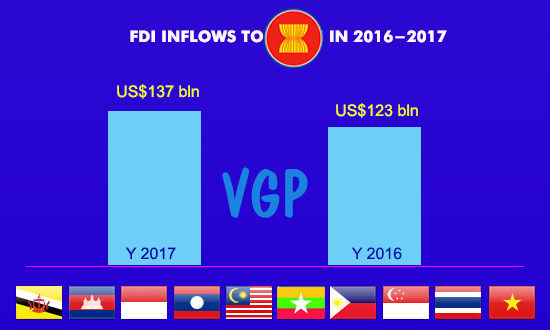

VGP - Foreign direct investment flows to ASEAN rose to all-time high of US$137 billion in 2017 from US$123 billion in 2016, according to ASEAN Investment Report 2018.

|

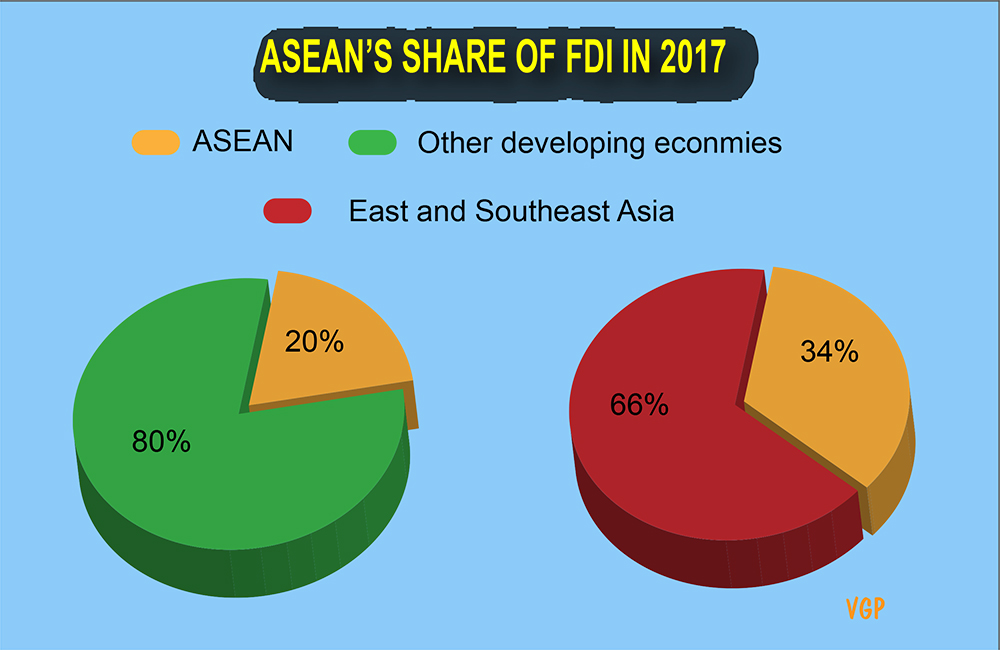

The 2017 figure pushed up ASEAN’s share of global FDI flows to developing economies from 18% in 2016 to 20% in 2017, and the bloc’s share of FDI flows to East and Southeast Asia rose from 31% in 2016 to 34% in 2017.

In 2017, FDI flows to Indonesia rose from US$3.9 billion in 2016 to US$23.1 billion in 2017 while flows to Thailand tripled to US$9.1 billion and flows to the Philippines saw a rise of 20% to US$10 billion.

FDI flows to Viet Nam was estimated at US$17.5 billion in 2017, up 10% from the previous year, reported the General Statistics Office of Viet Nam.

Intra-ASEAN investments, the biggest contributor, increased for the second consecutive year to a new height of US$27 billion.

|

Meanwhile, strong investments from China, the Netherlands, Germany, Switzerland, and Australia also contributed to the higher inflows in 2017.

Three member States, namely Singapore, Indonesia and Viet Nam accounted for some 72% of the FDI inflows, suggesting a high level of concentration of investment. However, FDI flows are gradually reaching more ASEAN countries.

Singapore remained the region’s biggest recipient, accounting for 45% of total FDI flows to ASEAN, though the volume declined from US$77 billion in 2016 to US$62 billion in 2017. The European Union and the United States were the largest investors in Singapore.

It would be interesting to see how FDI flow structure would change after Viet Nam and Singapore have sign free trade agreements with the European Union.

Top 10 investors

Intra-ASEAN investment remained the largest source of FDI, contributing 19% to total inflows, in which Singapore was the largest investor of all sources with flows rising from US$15.4 billion in 2016 to US$18.3 billion, followed by Japan and China.

The combined share of the top 10 investors in the region dipped significantly, from 95% in 2016 to 68% in 2018, suggesting a greater diversification in sources of investment in the region in 2017.

While the composition of the top 10 investors did not change much, there were differences in their order. The significant changes included a more than 100% rise in FDI from the Netherlands, a 71% drop in inflows from the United States and a decline by more than half in flows from the United Kingdom. Luxembourg dropped out of the top 10 while Germany joined the list. Investment from Australia and India rose./.

By Quang Minh