NPLs will be lowered to less than 3% by end of 2020

VGP – The Government determines to reduce the ratio of non-performing loans (NPLs) to below 3% by the end of 2020, said Deputy Prime Minister Vuong Dinh Hue.

|

|

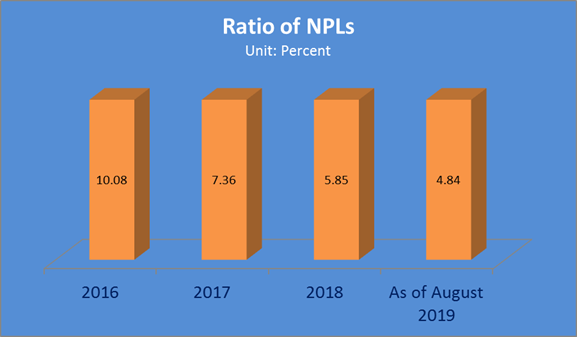

Ratio of NPLs from 2016 to August 2019. |

Settling NPLs and restructuring credit organizations is one of the top priorities of the Government over the past years as the ratio of NPLs rose as high as 10.08% at the beginning of the Government tenure, Hue said.

This is not an easy task as NPLs threaten macroeconomic stability, emphasized Hue while urging the credit institutions to take greater role in handling NPLs.

Since the introduction of the Resolution, clear changes have been recorded in settling bad debts, restructuring credit organizations, and banking system development, noted Deputy Governor of the State Bank of Viet Nam Nguyen Kim Anh.

Specifically, as of August 2019, the ratio of NPLs fell to 4.84% compared to 7.36% in 2017 and 10.08% in 2016, of which credit institutions’ bad debts accounted for 2%, she said.

The central bank said it had carried out 2,259 inspection tours between 2018 and August 31, 2019 in a bid to detect and issue warnings against risks that may cause instability to the banking system.

Total assets of the credit organizations reached VND 11.81 quadrillion by the end of August this year, up 6.7% against 2018, reported the central bank.

Credit organizations settled VND 236,800 trillion of bad debts since Resolution 42 was adopted, official statistics show. Noticeably, several banks have cleared their bad debts that they had sold to the Viet Nam Asset Management Company (VAMC).

The capital safety ratio of the whole banking system was 11.9% while capital adequacy ratio improved at 16.9% on average.

By now, 11 banks have met the Basel II requirements on capital adequacy ratio of at least 8%. The central bank set the goal to increase the figure to 17 by January 1, 2020./.

By Quang Minh